Warner Bros. Discovery Rejects Revised Paramount Bid, Reaffirms Commitment to Netflix Deal

Warner Bros. Discovery is holding firm on its deal with Netflix.

Despite a revised tender offer from David Ellison’s Paramount on December 22—backed by a personal commitment from Larry Ellison to fully guarantee the financing—WBD’s board made clear it isn’t changing course. In a letter released Wednesday morning, the board formally rejected the updated proposal and reaffirmed its support for the existing agreement with Netflix.

Paramount’s amended bid raised the termination fee to $5.8 billion, matching Netflix’s, and pushed the tender deadline into late January. The offer price itself remained unchanged at $30 per share, payable entirely in cash.

Those revisions, however, failed to sway WBD’s board.

“Your Board unanimously determined that the PSKY amended offer remains inadequate particularly given the insufficient value it would provide, the lack of certainty in PSKY’s ability to complete the offer, and the risks and costs borne by WBD shareholders should PSKY fail to complete the offer,” the board wrote.

In an accompanying filing, WBD characterized the revised Paramount proposal—even with Ellison’s backstop—as potentially the largest leveraged buyout ever attempted, arguing that the deal’s structure introduces significant execution risk.

“Changes in the performance or financial condition of either the target or acquiror, as well as changes in the industry or financing landscapes, could jeopardize these financing arrangements,” the board stated. It added that history shows acquirers and lenders in large LBOs often invoke closing-condition failures to exit or renegotiate deals. By comparison, WBD said the Netflix transaction’s more conventional structure carries materially less risk for shareholders.

While Paramount matched Netflix’s breakup fee, WBD contended that the real value of that fee would be far lower in practice. After accounting for a $2.8 billion payment owed to Netflix, additional interest expenses, and a $1.5 billion penalty tied to an uncompleted debt exchange, WBD estimated Paramount’s net termination payment would amount to roughly $1.1 billion.

The company also cited a New York Post report by Charles Gasparino suggesting Paramount was preparing a so-called “DEFCON 1” lawsuit if WBD declined its offer. That report reinforced the board’s view that Paramount could be a contentious counterparty.

“WBD continues to be of the view that PSKY is a litigious counterparty, which raises concerns regarding the likelihood that the Offer (or any related merger agreement) will be completed on the terms proposed,” the filing said.

Paramount and Ellison continue to argue that their all-cash proposal is superior to the Netflix deal, which includes a mix of cash, Netflix stock, and a residual interest tied to Discovery Global—a spinoff WBD plans to complete under the Netflix agreement.

Recent market performance has added fuel to the debate. Shares of Versant, which spun out of Comcast earlier this week, have fallen by double digits, lending some support to Paramount’s view that Discovery should be valued closer to $1 per share rather than the $3 to $5 range cited by other analysts. WBD, however, strongly disputes that comparison.

“While PSKY continues to point to Comcast’s Versant as a comparable public company, Discovery Global’s business has greater scale and profits, with a geographically diversified footprint and strong international presence,” WBD said.

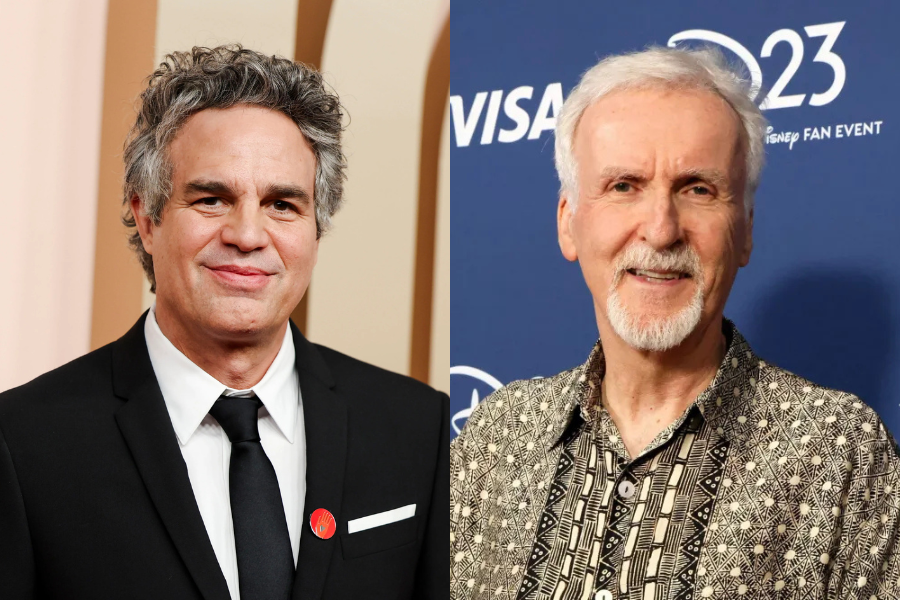

Announcing the revised bid last month, David Ellison reiterated Paramount’s stance that its offer represents the best outcome for WBD shareholders.

“Our $30 per share, fully financed all-cash offer was on December 4th, and continues to be, the superior option to maximize value for WBD shareholders,” Ellison said. He added that the acquisition would drive greater investment, increased content and theatrical output, and expanded consumer choice, while preserving and strengthening “an iconic Hollywood treasure” for the future.

TRENDING NEWS